If you missed last week’s newsletter, catch up here.

Any financial institution that launches what it believes to be a game-changing feature on April Fool's Day is deeply unserious. I could sugarcoat it, but after two days of rest, I’m feeling troublesome. Hello there, Sterling Bank.

Did anyone see Sterling’s announcement? Free transfers? Cool. What’s for lunch?

If you care (you’re here after all) about understanding this free transfer business, it starts in 2024 when Sterling ditched T24, the core banking software it used for years, and built its own: SeaBaaS. Word is, it was developed by companies that Sterling has a stake in.

The commercial reasons for developing SeaBaaS were solid:

Core banking systems like T24 or Finacle cost $10–25 million in annual licensing fees.

Building your own banking software means eating some upfront costs but potentially saving ₦10–16 billion a year.

After developing your core banking software, you can sell it to other banks and earn licensing fees.

For the first few months of SeaBaaS, things were rough. I tried and ditched the OneBank app after pulling out hair that I don’t have. But they’re now in the honeymoon phase: apart from the typical downtime here and there, things are mostly fine. Shop never burn.

Anyway, when you save ₦10–16 billion in costs, your body starts to itch. You want to plough that cost savings into new initiatives, like growing customer deposits, which stood at ₦1.8 trillion at the end of 2023 and ₦2.5 trillion in 2024.

So you gather your team in a boardroom, throw some ideas around, and someone blurts out: free transfers.

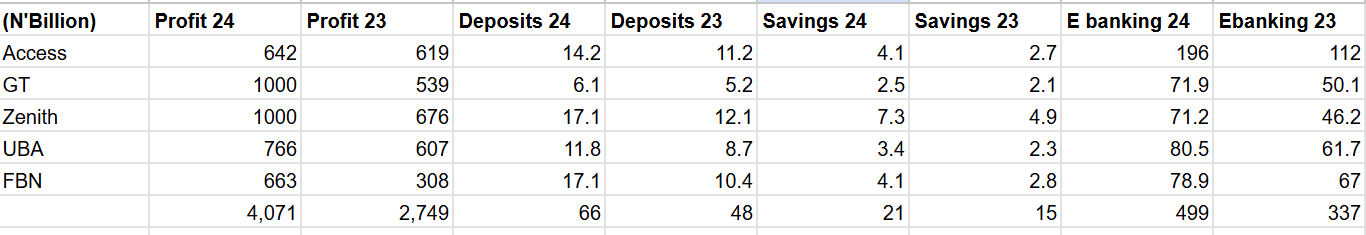

The logic of free bank transfers is easy to follow. Last week, Nigerian banks released their 2024 financial statements, and online chatter wasn’t kind. When banks report trillion-naira profits in a struggling economy, customers take it badly. It’s like, who exactly is suffering here?

Bank charges are a particular sticky point. And because the media must reflect public opinion, Premium Times ran a piece titled Inside the Excessive Bank Charges Killing Nigerians. Expectedly, it was heavy on populist sentiment:

“Ozovehe Blessing, an Abuja-based school teacher, regularly sends money to her younger brother at Kogi State University. She transferred ₦5,000 via her mobile app and was charged ₦10. When her brother withdrew from an ATM outside his bank’s network, he lost another ₦100. A POS agent might’ve taken ₦300–₦500. The ₦5,000 became ₦4,600 or less.”

The idea that bank fees are problematic isn’t new. It inspired a class of neobanks; digital challengers with slick apps and slogans promising to free you from bank charges. Millions of new customers later, free bank transfers are a relic of a VC-fueled past. They simply aren’t a thing anymore.

One of the lessons from that era is that customers take free stuff for granted, and freebies won’t break the trauma bond emotional bond Nigerians have with the tier-1 bank account they opened while they were in 100 level when the bank didn’t allow them to have less than a ₦2,000 balance.

Let’s look at those pesky banking fees:

Switching companies like NIBSS charge a ₦3.75 fee per transfer.

The banks pass on the costs to you and add a bit for their own margins (the CBN limits how much your bank can charge you).

The government also charges ₦50 stamp duty

Because you need cash now and then, you’ll need to use an ATM. If you use an ATM outside your bank’s network, you pay a fee (ATMs are expensive and unprofitable, which is why everyone’s running from them).

And if you use a card, in a single card transaction, 3–4 different parties each get a tiny fee to keep the system running. (Banks hate cards too).

You can vex and hide your cash under your pillow

Transfers are not free because the people who make the system work get a small cut to keep the lights on and pay salaries.

But here’s the point: even if transfers were free, no one gives a toss.

If customers cared about free transfers, Sterling’s app would be crashing hourly, and their branches would be overwhelmed. That’s not happening. Also, that ₦5 trillion increase in savings accounts across all banks in the last year alone would not have happened.

In 2025, reliability is the new game.

There was a time when speed was a differentiator. But most banks now complete transfers in 22 seconds or less. Speed is expected.

And when you can’t guarantee reliability, switching banks is easy. I opened five new accounts this weekend (don’t ask). Customers are ruthless.

If my bank is notorious for weekend downtimes, I’ll move my spending money to one of the China-backed apps. If it’s my salary account, I stick with it for the 25-26th of every month. But if it’s one of the other ten accounts, I won’t return. My patience for failure is now near zero.

And no matter what traditional banks do or say, even the best of them will have downtimes. Lord help you if you’re foolish enough to ask for a fill-up at the fuel station before paying, only to start sweating when your card doesn’t work or your transfer fails.

So no, free transfers won’t save you.

Customers want uptime. 99.9% reliability. They’ll stick with the bank that just works, not the one making noise about removing ₦10 fees.

Millions of Nigerians still use Orange Bank despite enduring four months of core banking chaos.

An entire generation for which the Orange Bank was a disruptor has their salary accounts there. Plus, because they’ve been around so long, and their customers have endured countless downtimes, I guess they’re just used to it? Yet, reliability is giving the competition a way in.

Today, people will receive those small 10-50k deposits through China-backed apps, but still trust traditional banks for the bigger ticket 2-3 million deposits. Eventually, the China-backed apps will be around long enough for that to change.

Anyway, back to Sterling. The irony is that the reward for their generosity might be a CBN memo asking why they’re undercutting fee limits. There’s no winning here.

I still have a Sterling account that sees very little use. The news of free transfers hasn’t changed anything. I suspect the same is true for thousands of others.

Ultimately, this free initiative will cost billions, and at best, will attract the kind of fickle customers who’ll leave the moment the freebies stop. Sterling may have saved money with SeaBaaS, but it can’t burn it forever.

So if you’re trying to stand out, forget free. Be reliable 9.7 times out of 10 and people will care.

Anything else, and you’re just crafting April Fool’s day campaigns for customers who will treat you like one in a long line of options.

If you made it all the way here, like this post and leave a comment or else I’ll call the Minister of interior and cancel Monday’s public holiday. Happy Easter people!

See you next Friday!

This was a really educating and enjoyable read. 👏🏾

Thought about moving money there but haven’t gone around to do it. I need more than free transfers to leave my “China Backed apps”