₦1 trillion reasons why free banking was never real

On learning that there's no free lunch in Freetown

Follow us on Twitter. I’ll come up with a good reason later.

Around 2019, the tech ecosystem’s consensus was that Nigeria’s commercial banks weren’t particularly good at banking. This was the dominant narrative. And honestly? There was some truth to it.

Disruptive innovation thrives on identifying the blind spots of incumbents and offering services that are niche at first, but eventually overthrow the olds. But in our rush to upend the old order, did we ask why things were the way they were?

The Banking Problems We Wanted to Fix

Back in 2019, fintech founders and their supporters agreed that:

Commercial banks didn’t care too much about everyday customers and, as a result, didn’t give loans to their millions of everyday customers.

Banking fees were too expensive, and commercial banks were vultures, profiting off their millions of customers with card maintenance fees and transfer fees.

The sky-high valuations of neobanks around 2020/2021 (Kuda was valued at $500 million in 2021) proved they could deliver better value to shareholders while redefining how banking should be done.

Neobank founders loudly championed these ideals as they built in public. It’s tempting to segue into how thin-skinned quite a few of these people have become, but let’s stay focused. I’m not rehashing the boring “tech media vs. founders” squabble. Let’s retire that fake beef this year, please.

Fast forward to today. The neobanks should be credited for improving speed, reliability, and delivering excellent digital-led banking experiences. They pushed commercial banks to step up.

But in their mission to upend the old order, how many things have they found the old order was right about?

Chesterton’s Fence is the idea that before you tear something down, you should understand why it was there in the first place. (Honestly, this would have made a great defense in those Nollywood flicks where Chiwetalu Agu was always fighting for property.)

The bank of the free and their pals loosely argued that transaction costs were too high, card delivery fees were ridiculous, and transfers should be free (or maybe these things were said only to attract customers?). But the reality is that banking is not free.

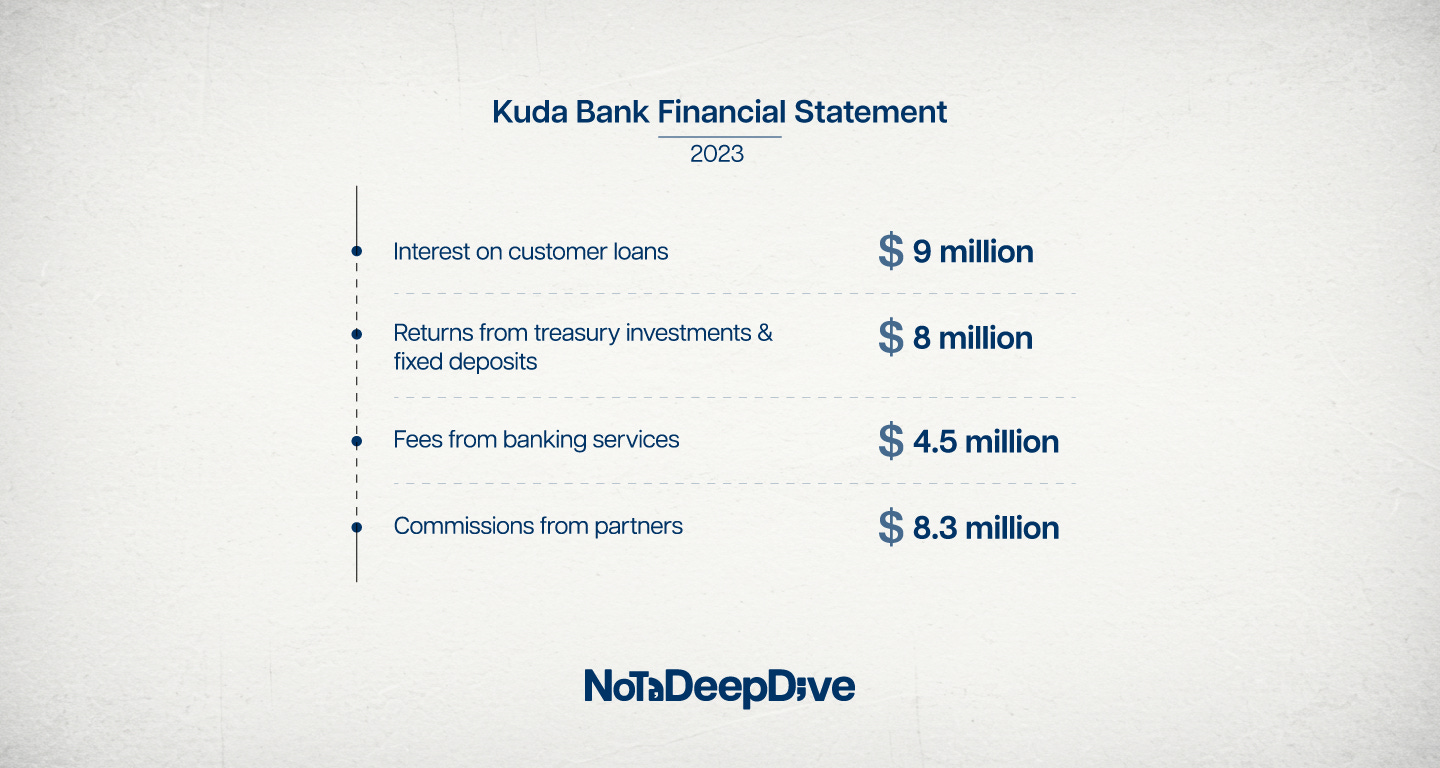

Here are some line items from Kuda Bank’s 2023 financial statement:

When customers enjoy “free” banking, someone else has to pay. Either the investors take the hit, or the company does. No startup will eat those costs forever.

One day, the startup will send an investor report showing eight months of runway left. Questions will be asked. The next thing you know, you receive an email: “You no longer have unlimited free transfers. You now get three free transfers a month (if you complete 400 transactions).”

Those free cards? No longer free. Now cards cost top money, and they’re not even Visa or MasterCard anymore; they’re Verve and Afrigo. Because, let’s be honest, when was the last time you paid for something online with those?

And the uncollateralized, easy-to-get loans based on some proprietary algorithm? Turns out, it was just lending 10-20k to everyone and tracking repayment patterns.

From 2019 to 2025, the most significant shift isn’t just how much better neobanks have become, it’s how much less naive they are.

The retail loans that were supposed to become mainstream once we sprinkled technology haven’t really played out. Without deterrents to discourage defaulting on loans, it turns out that very few people are credit-worthy. What’s the worst that can happen if you don’t repay a loan in Nigeria?

And if you’re a big man, it’s just a small matter of being named as a debtor by AMCON. You’re a Nigerian big man, what’s a little shame?

“Once your customer misses the first payment, that loan is gone,” the CEO of a digital lender told me over the weekend. His company has delivered billions in profits for three consecutive years, yet he admits he has learned expensive lessons along the way.

And in a week where two Nigerian commercial banks delivered N1 Trillion in FY profits, he believes fintechs shouldn't be as obsessed with acquiring millions of customers.

“Be conservative and focus on getting your money back. Realizing revenue can be a lot of accounting and creativity, but loan loss provisions are real money that will probably never come back.”

Here’s an excerpt from a news article:

“Analysis of the 10 banks’ financial results showed that cumulatively, their NPLs went up by 65% from N964.36 billion in 2022 to N1.6 trillion in 2023. Consequently, the lenders wrote off multi-billion naira non-performing loans to de-risk their balance sheet and improve asset quality.”

These unpaid loans have real consequences. We saw Heritage Bank’s banking licence revoked after 90% of its N700 billion loan book was considered lost or doubtful. We saw a fintech report N60 billion in loan loss provisions just a few weeks ago and Decagon did an about-turn from its model because people refused to pay back loans. NPLs are not just figures on a spreadsheet.

When traditional banks build these seemingly arbitrary hurdles, they’re just implementing risk management tools to keep the system sustainable.

If you still think no one is doing retail lending because they don’t care, start a fintech and fill the market gap. As one of my favorite Substack says, Fintech is easy.

Make of that what you will.

Happy Eid Mubarak, people! Whether you’re raising a glass or waiting for the Sultan of Sokoto to give the nod, here’s to expensive lessons and the fences we once thought we didn’t need.

Aside the NPLs, what is the real depreciating asset in digital banking, that is costing this much to run, despite their quarterly profit postings.